pay ohio unemployment taxes online

Apply for Unemployment Now Employee 1099 Employee Employer. For individual filing refund status identity confirmation online services and more.

Some People Not Receiving Unemployment 1099 G Tax Forms

Your Social Security number and drivers license or state ID.

. Files must be in the ICESA CSV or XML format. Please use the following steps in paying your unemployment taxes. Payments made online may not immediately.

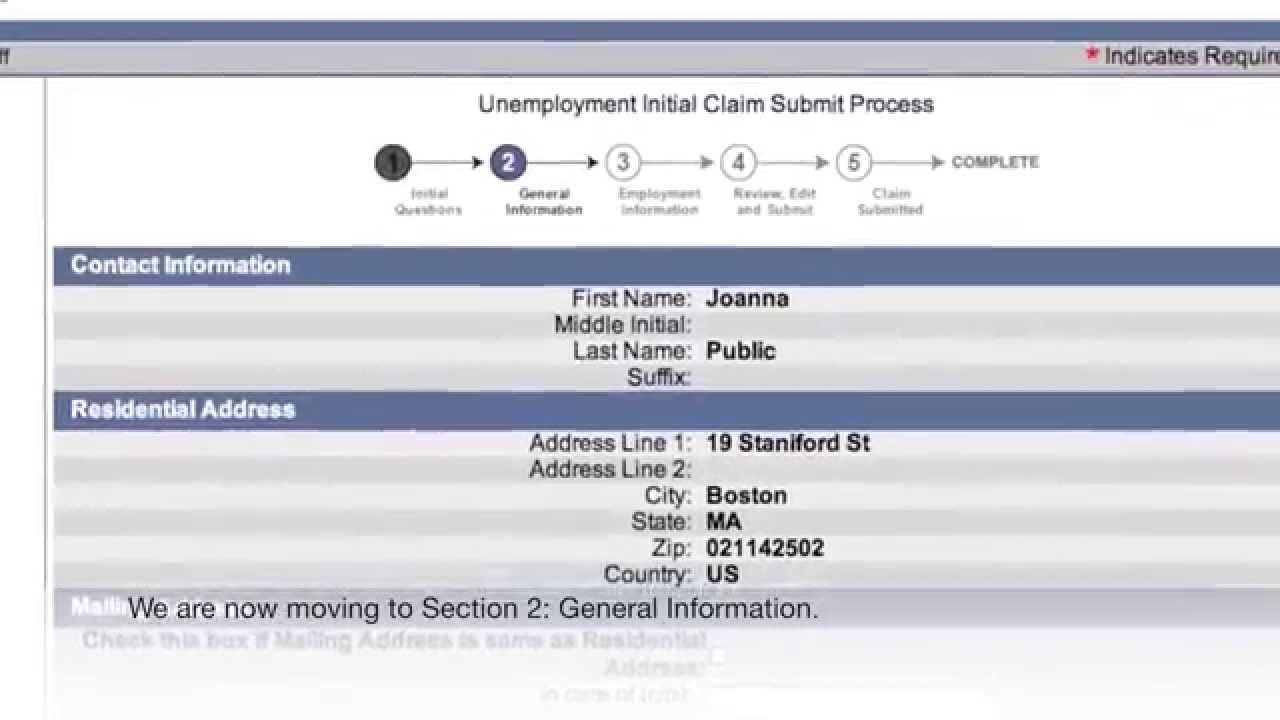

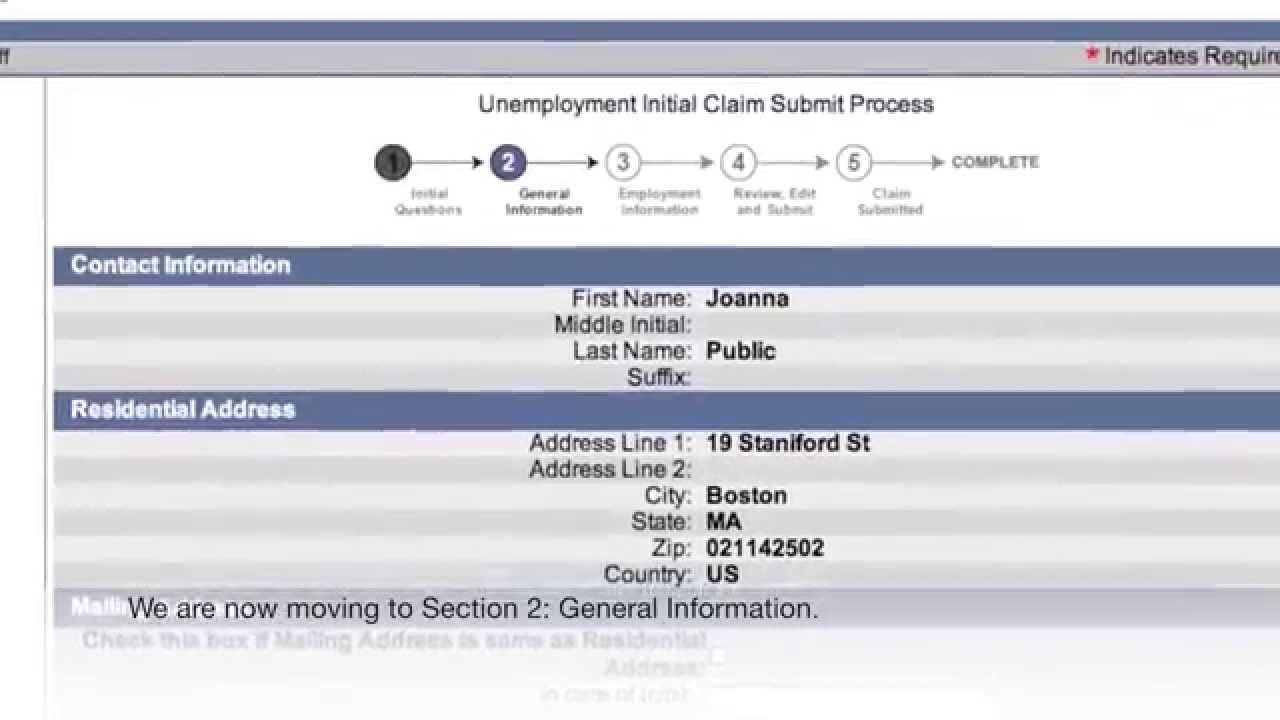

You will need to file a new claim if you have not applied for unemployment benefits at any time in the past 12 months. JFS-20106 Employers Representative Authorization for Taxes. The online initial application takes about 25 minutes.

Ohio Department of Job and Family Services PO. Mike DeWine Wednesday brought Ohio in line with federal tax law. Select the Payments tab from the My Home page.

You can apply for unemployment benefits online at the ODFJS website. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020. Office of Unemployment Insurance.

JFS-20125 UC Quarterly Tax Return. 100 free federal filing for everyone. On Employer Login page select and click Register to maintain TPA account online link.

Ad File your unemployment tax return free. To submit your quarterly tax report online please visit httpsthesourcejfsohiogov. Title badge loading.

Take Quiz Check My Refund Status. If you have questions contact the Office of Unemployment Compensation Division of Tax and Employer Service at 614 466-2319. JFS should send you preprinted forms.

The online registration process can take 1-2 days. Online Services - File Now Register for Online Services to use I-File view and make payments view and print tax documents View all services ID Confirmation Quiz Did You Get an Identity Confirmation Quiz Letter. Please visit httpsthesourcejfsohiogov to enter your quarterly reports online.

If your small business has employees working in Ohio youll need to pay Ohio unemployment insurance UI tax. If you are the account administrator for your. To file and pay online you can use either the ERIC system or the Ohio Business Gateway.

Make sure your employer number is shown on all copies being sent. To register as the Employer Representative click on the Create a New Account button below. When you apply you will need.

Additional information about the Ohio Unemployment Tax can be obtained from our home page or by contacting the Division of Tax and Employer Service at 614 466-2319. You may apply for a waiver of these assessments. Box 182059 Columbus Ohio 43218-2059 If you have any questions or concerns about making a repayment please call 877-644-6562 option.

Up to 25 cash back You can file your reports and payments online or on paper. Payment can be made by credit or debit card Discover Visa MasterCard or American Express using the departments Online Services Guest Payment Service directly visiting ACI Payments Inc. If you are disconnected use your username and PIN to log back on and resume the application process.

Your application is not filed until you receive a confirmation number. Bank Account Online ACH Debit or Credit Card American Express Discover MasterCard or Visa from the Make Payment page. File Unemployment Taxes Online.

Doing so greatly reduces the possibility of errors and allows for faster more efficient processing. Once the missing Quarterly Tax Return is processed you will be assessed penalty and interest. File Unemployment Taxes Online.

Employers who pay unemployment contributions. An employers filing frequency for state income tax withholding is determined each calendar year by the combined amount of state and school district taxes that were withheld or required to be withheld during the 12-month period ending June 30 of the preceding calendar year ie total state and school district income tax withheld for 7119. Used by employers to authorize someone other than the employer to provide.

Or by calling 1-800-272-9829. Select a payment option. To file on paper use Form JFS-20125 Quarterly Tax Return which contains both required sections.

Premium federal filing is 100 free with no upgrades for premium taxes. Once you have registered and received a User Name and Password click the Log-On to Existing Account button. Paper Form Exception Filing Information.

True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19. Should you have any questions please call the contribution section at 614-466-2319. Report it by calling toll-free.

To file and pay online you can use either the ERIC system or the Ohio Business Gateway. Unemployment Tax Payment Process. What are the consequences of failing to file or pay unemployment insurance taxes.

Logon to Unemployment Tax Services. Used by employers to submit quarterly wage detail and unemployment taxes. A convenience fee equal to 25 of your payment or 1 whichever is greater will be charged by ACI Payments Inc.

The SOURCE Upload File Employers and third party administrators can upload data directly in to The SOURCE. The Ohio Department of Job and Family Services Mike DeWine Governor Matt Damschroder ODJFS Director.

How To Apply For Ui Benefits Youtube

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Ohio Waivers Now Available For Pandemic Unemployment Overpayments Cleveland Com

How To Claim Unemployment Benefits H R Block

What Do I Do If Someone Applies For Unemployment Under My Name Transunion

These 33 States Are Still Offering 300 Lwa In Unemployment Benefits Forbes Advisor

How To Apply For Unemployment Benefits Online In Ohio Youtube

Unemployment Insurance Ohio Gov Official Website Of The State Of Ohio

Ohio Department Of Job And Family Services Filing For Your Weekly Unemployment Benefits Youtube

Maryland Unemployment Insurance Beacon Account Registration Youtube

Unemployment Benefits How To Get As Much Money As Possible Money

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Bookkeeping Business Money Lessons

Why Was Your Unemployment Claim Denied What Can You Do About It

Latest Jobs Report What Does It Mean For You The Housing Market